IBAN-Name Check

for your organisation

for banks

for municipalities

for accountants

for insurance agencies

for pension funds

for housing associations

for energy suppliers

for detective agencies

for human resources

for semi-government

for corporates

for telecom providers

Our products

Checks for Banks

All payments will be checked directly in the online banking environment.

Comply with Instant Payments Regulation

How BNG Bank uses our Solution

For which processes?

Comply with Instant Payments Regulation

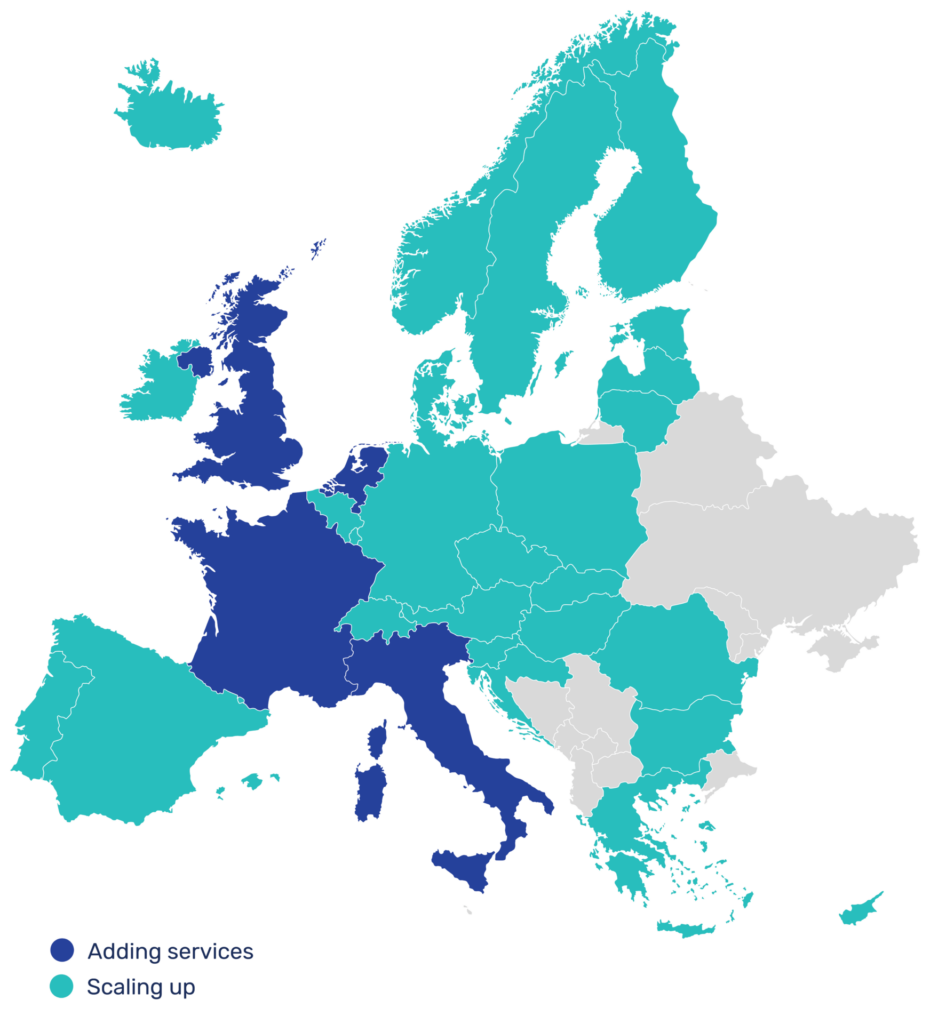

Implement the IBAN-Name Check and meet the requirements of the European Commission.

Fraud and errors investigation

Make sure the account number belongs to the given

name and avoid incorrect payments and direct debits

Smooth onboarding process

Prevent dropouts during the onboarding of new customers and boost your conversion.

Comply with AML- and KYC requirements

Use the matching results for both internal and external audit.

We are on a mission to protect both our clients and their customers against the growing threat of fraud worldwide, both cross-border and multi-domestic.

– David-Jan Janse, CEO SurePay

What our clients say

Frequently asked questions

Don’t worry, your account will be created shortly. You will receive a confirmation mail with your personal login details within 2 working days.

Email confirmation is a mandatory step to complete the registration on the portal. Every user will receive a separate email from the system with a 24 hours valid link. Once the user clicks on the link, the email is confirmed and they can proceed to the next step.

Every user can login via portal.surepay.nl Once they fill in their organisation name, previously provided by SurePay, email address plus password, and the one time code provided by the MFA app, the login is completed and the user is ready to run their checks.

Single checks can be done on the main page. For every entry, the user has to provide a name and an IBAN before hitting the “Check” button. The results will be displayed on the same page.

File check feature is available for Business PRO customers and it can be found on the top menu bar. Once the user clicks on the “File check” button, they will be redirected to a new page where they can upload or simply drag & drop their file. A file template is available on this page below the “Upload file” option and can be used as reference. The first three columns have to be filled in, as described in the template, before uploading the file. Once the check is completed, the file containing the results will be displayed on the right side of the page, along with the download option.

Ready to get started?

Discover the benefits of integrating

our API into your systems

Sign up now for our IBAN-Name Check Portal and get 10 checks for free!

Our clients