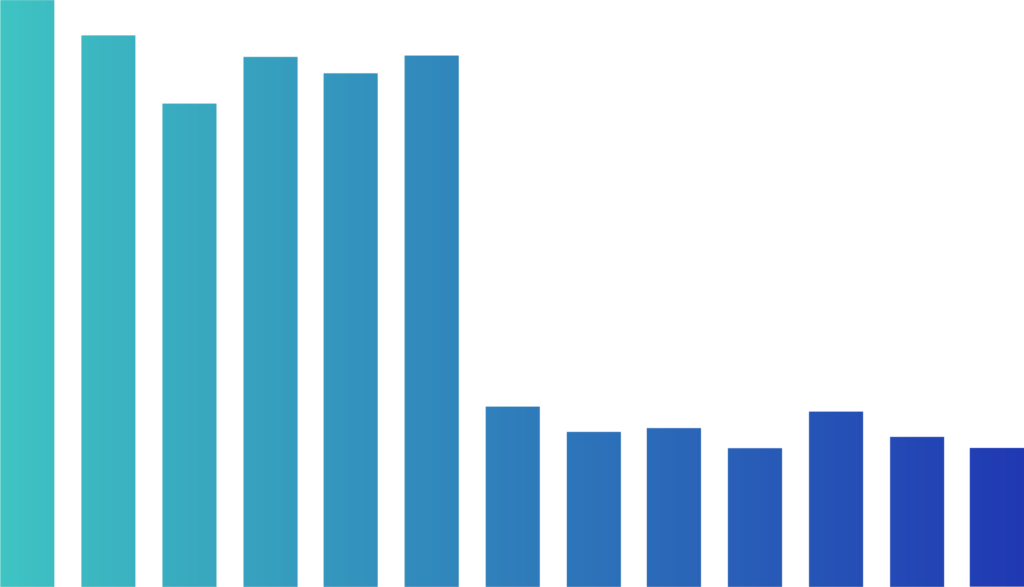

Drop-out rate for online onboarding reduced from 100% to 15%.

Insurance client case

No more physical signature required

The service has been deployed on a.s.r. Life’s claims process for payout. The reason for using SurePay’s service was because a.s.r. previously had to obtain physical signatures before a claim could be paid. This was a time-consuming and labor-intensive process, sometimes taking six to eight weeks until a customer received his or her money because this signature had to be validated first.

API integration

a.s.r. uses the API integration; this service is deployed in the online environment. The response is received immediately when a payment is requested. Instead of requesting a physical signature, we can immediately perform a data check on name and account number. This is done in combination with iDIN; customers can adjust their data themselves in the ‘my environment’ and a physical signature is no longer necessary.

Less time for administration, fewer mistakes

In addition to these advantages, the IBAN-Name Check enables an immediate check to be carried out and the drop-out rate at online onboarding is reduced from 100% to 10 to 15%. When a claim is requested, the amount is in most cases available within 4 working days. In short: fewer hours, less administrative work and less failure due to the use of this SurePay solution

''Because of iDIN, a physical signature is no longer needed. In addition, we use SurePay's IBAN-Name Check to determine whether we will disburse to the correct account. Sending/uploading a copy bank statement by the payee is no longer necessary. This has reduced the dropout rate for online onboarding from 100% to 10-15% and we have much less administration.''

– Mieke Koevoet, IT consultant a.s.r. insurance

More interesting client case studies

IBAN-Name Check for

Organisations helps Grolsch with preventing fraud

After attempts at fraud at a

international fellow brewery,

Grolsch started to use the

IBAN-Name Check for Organisations.

Decrease in fraud and fake orders at STRATO

Since the introduction of the IBAN-Name

Check we see over 80% less

fraudulent orders relative to

from a year earlier.

Mitros improves processes

by using the IBAN-Name

Check for Organisations

Thanks to this solution, we know for sure

That we can get to the right person or

organisation pay.